- Simplified Finances: One EMI, one lender, one due date less hassle.

- Lower Interest Rates: Consolidated loans often come with lower rates compared to credit cards or small personal loans.

- Better Cash Flow: Reduced EMI burden helps free up money for savings or investments.

- Improved Credit Score: Timely payments on a single loan can gradually improve your creditworthiness. Ideal for Higher Loans and Multiple EMIs

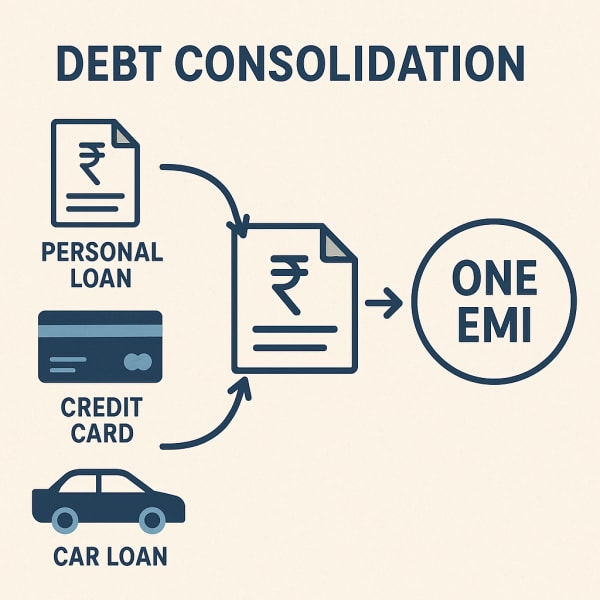

- If you are currently managing: Multiple credit card bills, Personal or business loans, Car loans or app-based EMIs, then consolidation helps you merge them all into one structured repayment plan.

How Does It Work?

- Assessment Your existing loans and EMIs are evaluated.

- Approval – A new consolidated loan is approved at a suitable rate.

- Closure – Old loans are closed, and you are left with one consolidated EMI.

- Repayment – You repay in a fixed tenure with predictable monthly payments.

Individuals struggling with too many EMIs.

Borrowers paying high interest on credit cards.

People planning to restructure finances for better stability.

Business owners juggling multiple short-term loans.

Things to Keep in Mind

Ensure the new loan actually offers a lower rate.

Check processing fees and other charges.

Avoid missing payments discipline is key.